If you’ve ever tried crypto futures and options (F&O) trading, you know it’s not just about finding the right contract – it’s about how smoothly the platform handles your decisions in real time. Even a small lag when placing a futures order or a confusing options layout can throw your strategy off.

That’s why I decided to give Delta Exchange a proper try. Over the past month, I placed trades in futures, tested options for hedging, and even explored trackers when I wanted exposure without holding the asset. I also explored a bit with algo trading to see how automation fits into the mix.

This review is my honest take on what it felt like to use Delta Exchange as a trader who cares about speed, costs, and usability.

Getting Started on Delta Exchange

My first step was setting up an account, which was fairly quick. The KYC process required the usual ID verification, and once approved, I could move money in and out seamlessly. What stood out right away was INR support – it felt practical to fund trades directly without the hassles of currency conversions.

After logging in, the clean dashboard made it easy to spot different products – futures, options, and trackers – neatly in their own section. That first impression gave me confidence that I wouldn’t be buried under confusing menus before I could start exploring crypto F&O trading.

Exploring Delta Exchange’s Product Suite

One of the first things I noticed on Delta Exchange is that the platform doesn’t stop at offering just one type of contract. Its product mix feels built for different trading needs, whether you’re testing crypto F&O trading for the first time or running structured strategies.

India’s leading crypto trading platform: Crypto F&O trading now simplified

Here’s how each product fits in practice:

- Futures

I started with BTC perpetual futures – straightforward, with the option to use leverage up to 200x. Unlike dated futures, perpetual contracts don’t expire, so they track the spot price more closely. That gave me flexibility to hold positions longer without worrying about rollovers.

- Options

Delta Exchange offers European-style options on BTC and ETH. I tried to hedge a BTC long during a volatile week. Having multiple strikes and expiries helped me set a risk-defined position instead of stressing over stop losses.

- Trackers

Trackers felt closest to spot trading. For example, if you want to buy Bitcoin tracker, it captures the upside without actually holding BTC in your wallet. Since they’re not leveraged, I didn’t face the risk of liquidation, which made them a simpler entry point.

Beyond these, Delta also provides basket orders in its strategy builder – handy if you want to place multiple futures and options trades together and offset margin.

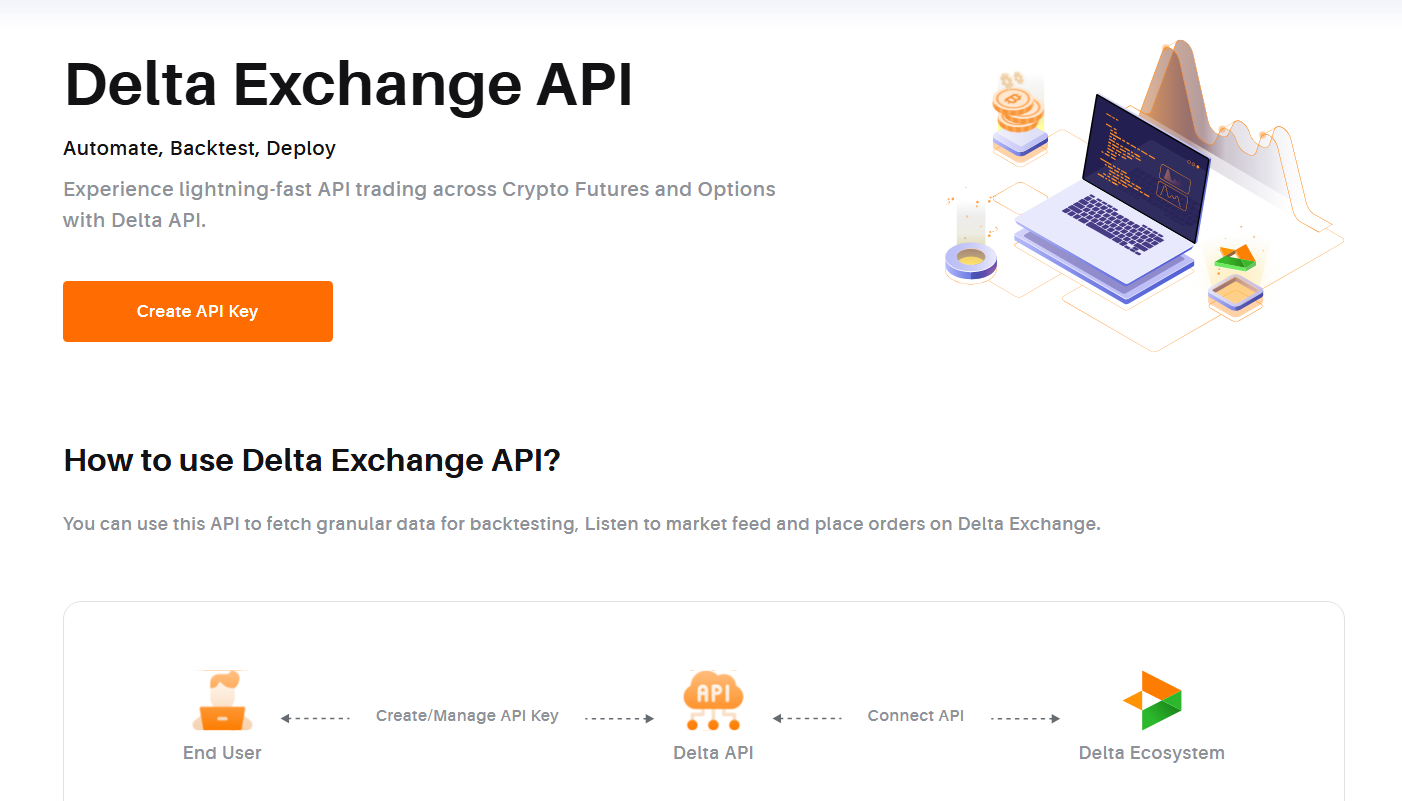

On top of that, I tested algo trading with API Copilot. Think of it as an AI assistant for APIs – you ask it to generate code or debug an error, and it helps you build automated trading scripts without being an expert coder.

This combination of products and tools kept me from hopping between platforms and gave me room to experiment with different approaches under one roof.

Fees, Liquidity, and Execution

One of the things I kept an eye on during my month with Delta Exchange was how much each trade cost me. Compared to other crypto trading platforms, the fees here felt lighter on the pocket:

- Futures: 0.05% taker, 0.02% maker fees.

- Options: 0.015% both taker and maker fees.

- Trackers: 0.05% both taker and maker fees.

I also noticed that liquidity on BTC and ETH contracts was solid – I never faced much slippage while entering or exiting positions. Execution speed was consistent, too, with orders filling quickly on both web and mobile. Since Delta is FIU-registered and regulated, I felt a level of trust that’s often a challenge in crypto F&O trading platforms.

Features That Stood Out

Algo trading on Delta Exchange

Across the month, here are a few features that stood out for me as a trader exploring Delta Exchange:

- Mobile app vs web: Both felt smooth and reliable; I could switch between them without losing track of my trades.

- 24/7 customer support: Queries were answered quickly, even late at night.

- Risk management tools: From automated strategies to payoff charts before confirming a trade, these helped reduce guesswork.

- Demo account: Probably my favorite – testing trades without risking real money gave me confidence before moving into live crypto F&O trading markets.

Some Gaps and Hurdles To Tackle

Delta Exchange gave me a fair sense of where the platform shines and where it leaves room for improvement.

Trackers, for example, are a great way to get exposure without leverage, but they’re currently limited to BTC. Expanding them to other coins could attract traders who prefer simpler exposure beyond Bitcoin.

Another gap is the absence of spot trading – if you’re someone who likes to switch between spot and crypto F&O trading in one place, you’ll need another platform for that.

But like any crypto trading platform, risks remain. If you jump in without a basic grasp of how F&O contracts work, you could end up burning capital quickly. Trade cautiously and test strategies first.

Final Thoughts

To wrap up, I’d say Delta Exchange is a solid option if you’re serious about exploring crypto F&O trading. The platform gives you flexibility with features like algo trading and small lot sizes, but it’s not without gaps. Approach it with a clear strategy and treat it as a tool, not a shortcut.

To know more, visit www.delta.exchange and join the community on X for the latest updates.

I have been writing about crypto for over two years. I have a vast amount of experience in the industry and my work has been featured on some of the biggest publications in the space.