Top 3 Bitcoin mining news stories today

Image by 3D Animation Production Company from Pixabay

We don’t often break news, as compared to the rest of the news community we are a small website. However, we do our best to provide you with the latest news, regardless of where the information comes from. We believe in giving credit where it’s due, so without further delay, here are the top 3 news stories about Bitcoin mining in the past week.

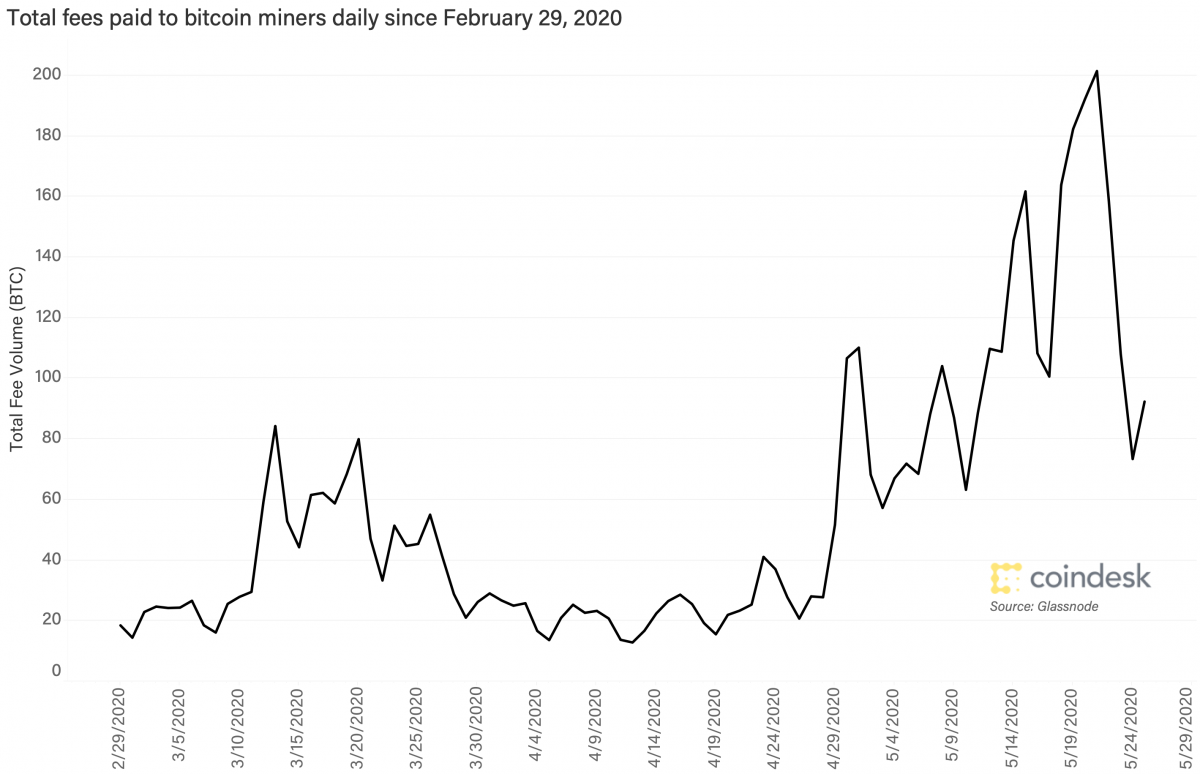

It seems that Bitcoin miners were celebrating the international workers’ day with extra effort on part of the miners. In this lucky coincidence, Bitcoin miners managed to complete sixteen Bitcoin blocks in one hour, according to Coindesk and their source Blockstream.

The onset of this industrious hour was noticed by Twitter user @Kexkey, where he spotted four blocks being completed in o...