Make CPU Mining Great Again — Official MinerGate Blog

by

MinerGate Mining Pool

February, 15, 2020

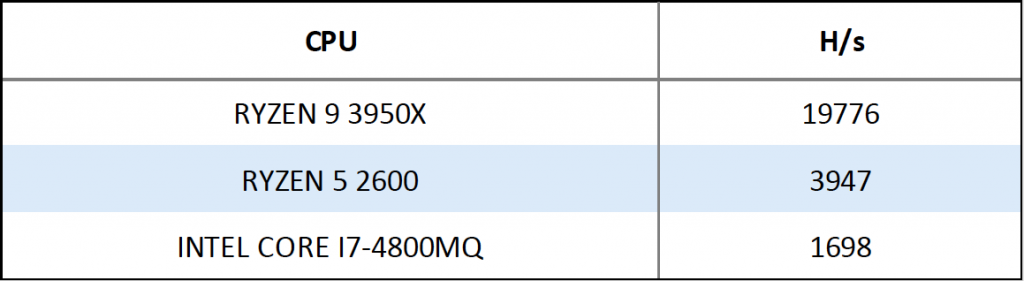

Monero (XMR) has successfully hardforked on November 30th, at block number 1978433. The fork has changed the CryptoNightR mining algorithm to the new RandomX Proof-of-Work algorithm. Although the main aim of the upgrade was keeping Monero completely resistant to ASIC mining, thus maintaining the coin decentralized, RandomX has essentially moved XMR mining to CPU, which is no less important. What is the hard fork about? Being one of the top cryptocurrencies by market capitalization, Monero for sure is one of the most popular coins at the moment, not least...